How the Industry Has Matured Since the mid-2000s

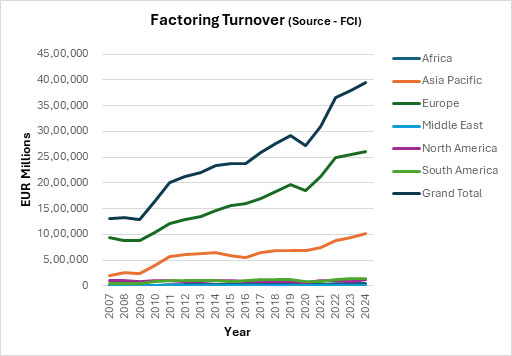

Over the past two decades, global factoring has evolved from a specialised liquidity tool into a mainstream credit instrument. FCI data shows the market growing significantly between 2007 and 2024, with both domestic and international factoring becoming far more established in supporting SMEs and corporates across industries.

Consistent Long-Term Growth

From the 2007 to 2024, global factoring expanded at an average annual rate of around 7%, demonstrating steady and resilient market expansion, regardless of economic cycles.

Rebounding through Crisis

Growth surged during recovery periods, yet remained stable even amid geopolitical uncertainty and trade fluctuations.

In 2022, factoring volumes grew by approximately 18.3%, following a rebound from modest contraction in 2020. This was among the strongest annual increases recorded, driven by renewed trade activity and increased liquidity needs. Growth moderated in 2023 (approximately 3.6%) and 2024 (approximately 2.7%), indicating the market had settled into a rhythm of steady expansion rather than rapid rebounds.

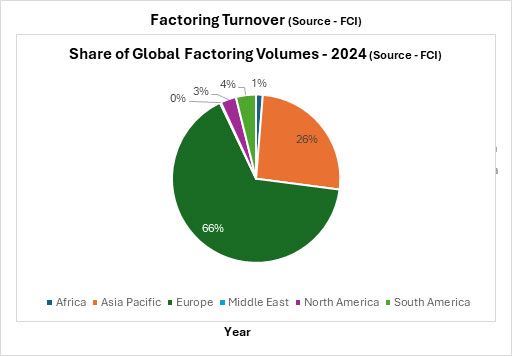

Regional Shifts in Market Share

Factoring remains concentrated in Europe, which accounts for roughly 67% of global volume, though growth there recently hovered around 2–3%. Meanwhile, Asia‑Pacific emerged as the fastest-growing region, expanding nearly 17% in 2022 and 7% in 2023. The growth has been primarily driven by China. In 2024, volumes in Asia-Pacific reached close to €964 billion in volume. Notably, India recorded over 120% year-on-year growth in 2024, crossing volumes of approximately €38 billion; thanks primarily to TReDS, central bank approved online marketplaces.

The Americas also posted solid gains, about 14.5% growth in 2024 with strength in both North and Latin American markets, while Middle East & Africa saw mid-single-digit increases fuelled by expanding regulatory awareness and institutional adoption in countries like Morocco and South Africa.

Key Drivers Behind Industry Maturity

SME Liquidity Needs: As businesses increasingly operate on 30–90 day receivables terms, factoring became a flexible, asset-backed financing option well-suited for platforms without access to collateral.

Shift Toward Open Account Trade: With rising cross-border commerce and open-account structures, companies turned to factoring to manage buyer risk and bridge payment cycles.

Digital Infrastructure & Risk Scoring: Expansion of e-invoicing, real-time credit checks, and digital onboarding enabled factoring companies to onboard, assess, and disburse faster and more securely.

Regulatory Support & Education: Countries implementing legal frameworks for invoice assignment and factoring, along with awareness campaigns, boosted acceptability; though in some regions, debtor assignment restrictions and trust issues still limit adoption.

The Road Ahead

Looking toward 2030, experts anticipate global factoring volume could exceed US$ 5.5–6 trillion; driven by SMEs scaling in emerging regions and tech-enabled finance. Growth in supply chain finance continues alongside, especially in economies with sophisticated digital trade systems.

However, key barriers remain: uneven legal frameworks, limited credit bureau coverage, and ongoing need for financial education; particularly in frontier markets. Addressing these challenges is critical to unlocking the next wave of factoring adoption.

Conclusion

Factoring has transitioned from a niche financing modality to a mainstream tool for global working capital management. Over the past 17 years, it has demonstrated steady growth (around 7% CAGR), resilience to crises, and broadening geographic reach.

As the industry continues to embrace digital platforms, clearer regulations, and ecosystem collaboration, it stands poised to support more businesses, especially SMEs; with essential liquidity, risk mitigation, and operational expansion.

Leave a Reply